Isle of Wight County adopts lowered 71-cent real estate tax rate

Published 6:00 pm Friday, June 9, 2023

|

Getting your Trinity Audio player ready...

|

Isle of Wight County supervisors have reduced the county’s real estate tax rate by 14 cents to lessen the increase homeowners will see on their tax bills.

Residential, commercial, industrial and agricultural property valuations surged by an average of 28% as a result of the state-required, four-year reassessment. Single-family homes went up 34% on average, though some residents saw their valuations more than double.

The unanimous June 1 vote marks the first lowering of the rate in 16 years. The new rate is 71 cents per $100 in assessed valuation, a 16% decrease from the 85-cent-per-$100 rate that had been in place for the past nine nears.

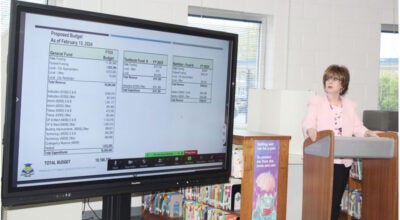

The supervisors voted in May to adopt a $95.5 million budget for the 2023-24 fiscal year, which starts July 1, but were required under state law to postpone voting on its tax rates until after holding a public hearing on the “effective” rate.

Even under the 71-cent rate, Isle of Wight is expecting roughly $3.7 million in additional real estate revenue from the new valuations. A so-called “revenue neutral” rate of 66 cents would have eliminated the revenue gain and resulted in the county taking in roughly the same amount of real estate taxes it received for the 2022-23 fiscal year.

The roughly 7% difference between the break-even 66-cent rate and the adopted 71-cent rate is what’s being termed an “effective tax rate increase.”

The hearing drew four speakers, all of whom urged the supervisors to adopt a rate lower than 71 cents. Dean Jones of Walters said his home’s valuation rose 58% while his neighbor’s went up only 38%.

“That’s just totally ridiculous,” Jones said.

According to Board of Supervisors Chairman William McCarty, adopting a 66-cent rate would have resulted in a disparity where homeowners whose valuations rose by 29% or less would have seen a decrease in the amount of real estate taxes they pay, while those who saw a 30% or higher increase would still have ended up paying more in taxes despite the lowered rate.

McCarty noted his own home had risen 40%.

According to Commissioner of the Revenue Gerald Gwaltney, the supervisors have the authority under state law to call for a new reassessment by majority vote if they believe the assessed values to be erroneous, which would prompt the state Department of Taxation to conduct its own sales study.

Such a challenge hasn’t happened in Isle of Wight since the 1980s. According to McCarty, were the board to do so, there’s a “good chance” the valuations would rise even higher given the hot real estate market the county is presently seeing.

Supervisor Don Rosie noted Isle of Wight has become “a very desirable place to live.”

“I can’t stop people from wanting to come here” or paying “crazy prices” for land, Rosie said, noting his own home’s valuation had also risen 40%.

Supervisor Joel Acree noted the growth the county has seen in its northern end has allowed county government to operate at a roughly 4% to 5% increase in its budget annually without a tax rate increase, to include funding the construction of the new Hardy Elementary School set to open in September.

With the 71-cent rate, Isle of Wight will have “the lowest tax rate in Hampton Roads,” Acree noted.

A revenue-neutral rate would not be a “good business” decision, Supervisor Rudolph Jefferson said.

Supervisor Dick Grice noted the $95.5 million budget includes a roughly $3.3 million or 12% increase in school funding, up from the $2.79 million increase proposed in April when the supervisors were planning a 75-cent real estate tax rate. It includes an additional $3.1 million, or 5.2%, for all other county expenses.

The budget also provides each full-time county employee with a 4% raise and $1,000 bonus, and includes funding to increase the amount of relief elderly and disabled homeowners can receive on their real estate tax bills from $1,000 to $2,000. To qualify for the credit, homeowners must be age 65 and up or totally disabled, have a maximum household income of $54,600 and a maximum net worth, excluding the value of their house and one acre, of $228,596.

“What do you want to give up? Who do you want to penalize?” Grice asked.