Tax increase proposed in county budget

Published 6:41 pm Friday, April 5, 2019

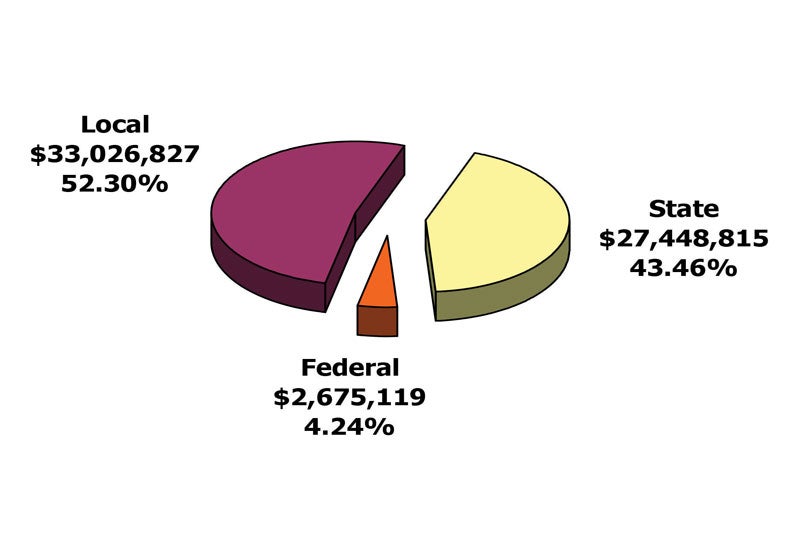

- These are the projected sources of revenue for the initial fiscal year 2020 budget. Courtesy | Southampton County

COURTLAND

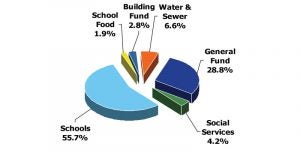

These are the projected expenditures for the initial fiscal year 2020 budget. Courtesy | Southampton County

Unless money falls like manna from heaven onto Southampton County in the very near future, residents could see a 4-cent increase on their real estate tax rate, putting the rate at 89 cents per $100. This would also apply to people living in mobile homes.

The proposal was suggested by county administrator Mike Johnson in the initial Fiscal Year 2020 draft budget, which was released this past Wednesday.

The proposed budget is $63,150,761, which is $2,301,938 more than the 2019 budget of $60,848,823.

To enact such a tax increase, local revenue is projected to increase by $763,531 or 2.37 percent. Johnson noted, “Otherwise local revenues increase by less than 0.3 percent.”

There are no other proposed tax levies or fines.

In his budget message, the administrator wrote, “Nobody likes an increase in the tax rate. I don’t like recommending one. You don’t like having to consider one. And your constituents certainly don’t like paying more each year.

“That said, unless we’re able to grow our tax base with new private investment, increases are inevitable. It simply takes more to operate every year. As an example, Southampton County Schools experienced a 24 percent increase in their health insurance premiums this year, at a cost of more than $650,000.”

He also noted another example of the volunteer rescue squads, stating, “They continue to do a fantastic job — but they need extra help. The cost of maintaining the existing contract and adding one additional night of contracted coverage is more than $337,000.”

Those are the two chief reasons for the proposed rate increase, and each increase of one cent creates about $162,000 more money.

County schools are funded at $13,131,575, which is 4.32 percent increase above this existing fiscal year, but it’s still nearly $950,000 less than what the board asked.

The general fund would be $13,218,031, which has a 3 percent cost of living adjustment for county employees. There’s also a 5 percent increase in the general fund contributions for fire departments and rescue squads.

Other bullet points of note:

• Includes sufficient funding (+$32,000) to finance one new roll-off solid waste truck

• Includes $56,000 to install a used solid waste compactor at the Sebrell Refuse Convenience Site to more efficiently manage recyclables

• Factors in reductions in solid waste disposal expenses (SPSA advertised rate for FY 2020 is $57/ton)

• Provides $15,000 for contracted recreational services with CCCC

• Provides $15,000 for youth activities

Dallas Jones, board chairman, said on Friday afternoon that he’s not yet read through everything. But as to the proposals from Johnson, “This is what he has recommended. There’s no where we can find the extra penny. I have to go along with what he’s recommended. He’s not steered us wrong. He’s still looking out for own welfare. We have to support him as well as he supports us.”

Jones added that he’s “not totally decided yet” about the budget proposals, and will also consult with fellow board members.

Department presentations and requests will come on Wednesday, April 10 and 17, both at 6:30 p.m. Finalizing the budget will be around Monday, April 22, after which it’ll be advertised in The Tidewater News on Sunday, April 28. The second opportunity for public comment will be for the final draft on Monday, May 20. The adoption of the budget and tax rates is anticipated for Tuesday, May 28.