City owed $1 million in back taxes

Published 9:54 am Tuesday, August 17, 2010

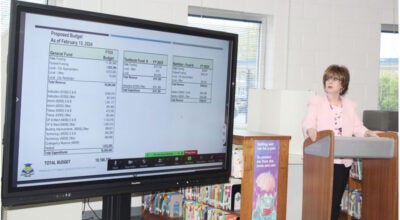

FRANKLIN—The city of Franklin is owed more than $1 million in delinquent taxes, Treasurer Dinah Babb told the City Council Monday night. The majority of that amount is owed for recent years.

The $1 million figure, current as of Aug. 2, includes delinquent real estate, personal property, business license and meals and lodging taxes. Delinquent real estate taxes account for nearly $524,000 of the total taxes owed and personal property taxes account for nearly $430,000 of the total. Delinquent tax bills are assessed a one-time 10 percent penalty the day after payment is due and 10 percent interest annually.

“That’s the max we can charge annually,” Babb said.

Earlier this year, council members voted to reorganized the collections department and put it under the control of the treasurer. Since then, Babb said staff has been busy learning new collections procedures, reviewing policies and establishing new guidelines.

Babb said the city sent out 3,300 letters to residents with delinquent personal property bills in late April. So far, that has netted $36,000.

The city has also started issuing tax liens against wages, Babb said.

“As of this date, we have garnished 150 delinquent taxpayers. With the economy the way it is, we are only doing 25 percent,” she said.

The most lucrative collections tool to date is the debt setoff program, which allows the city to intercept tax refunds and lottery winnings from delinquent taxpayers. The city has netted more than $100,000 in debt owed to the city using the program.

Babb said she hopes to implement the DMV stop program very soon to collect delinquent personal property taxes. The program prevents vehicle registration renewal until delinquent taxes are paid. She is also looking into the possibility of tax sales for seriously delinquent real estate bills.

Babb said her office is working with people who make an attempt to pay their debt to the city.

“If we’ve got a signed agreement and they’re willing to make up a payment arrangement with us then we do not do any of the collections (tools),” she said—except debt setoff.

City Attorney Taylor Williams said Samina Azhar, the woman who ran the Burger King on Armory Drive, still owes the city around $47,000. She was convicted of failing to pay the city’s meals tax and ordered to make monthly payments.

“We have collected some monies, but certainly she is not on schedule,” Williams said, adding that he has been in communication with Commonwealth’s Attorney Eric Cooke to get the Azhar to pay the amount owed.